Case Study

Equals Money

Redefining Business Finance Through a Unified Platform

Project Overview

Role: Head of Product Design

Timeline: 20 months

Team: 4 Designers, 5 Product Owners, 3 Product Squads, CPO

Equals Group set out to solve a fundamental issue: multiple, disconnected business offerings serving different audiences. Products such as international payments, expense management and faster payments had grown in isolation, limiting scalability and brand coherence.

The vision was ambitious: to unify all products into a single business account, positioning Equals as one of the few companies in the market capable of delivering a complete, multi-layered B2B financial suite.

Challenge

Each product operated on legacy technology, creating inconsistent experiences and limiting opportunities for cross-selling and integration. The business needed a universal platform that could support multi-currency accounts, expense cards and payments within a single interface.

Business objectives:

- Replace legacy systems with a unified solution

- Enable multi-currency and real-time balances

- Integrate accounting and payments

- Improve scalability and retention through a centralised experience

"We weren't just designing a product; we were redefining how Equals operates as a connected ecosystem."

My Role

As Head of Product Design, I led the design strategy and managed the design process across three squads. I worked closely with product and engineering to deliver the end-to-end experience while aligning with senior stakeholders, including the CPO.

A key focus was cultural transformation. Before this project, product, design and development worked largely in silos. I established cross-functional collaboration as the norm, ensuring design became the connecting force that united teams and accelerated delivery.

Planning the Design Roadmap

Before any design work started, I created a structured roadmap to plan how we would design, test and deliver each part of the product. This roadmap aligned design, product and engineering around shared milestones and dependencies, ensuring every team understood what needed to happen, when and why.

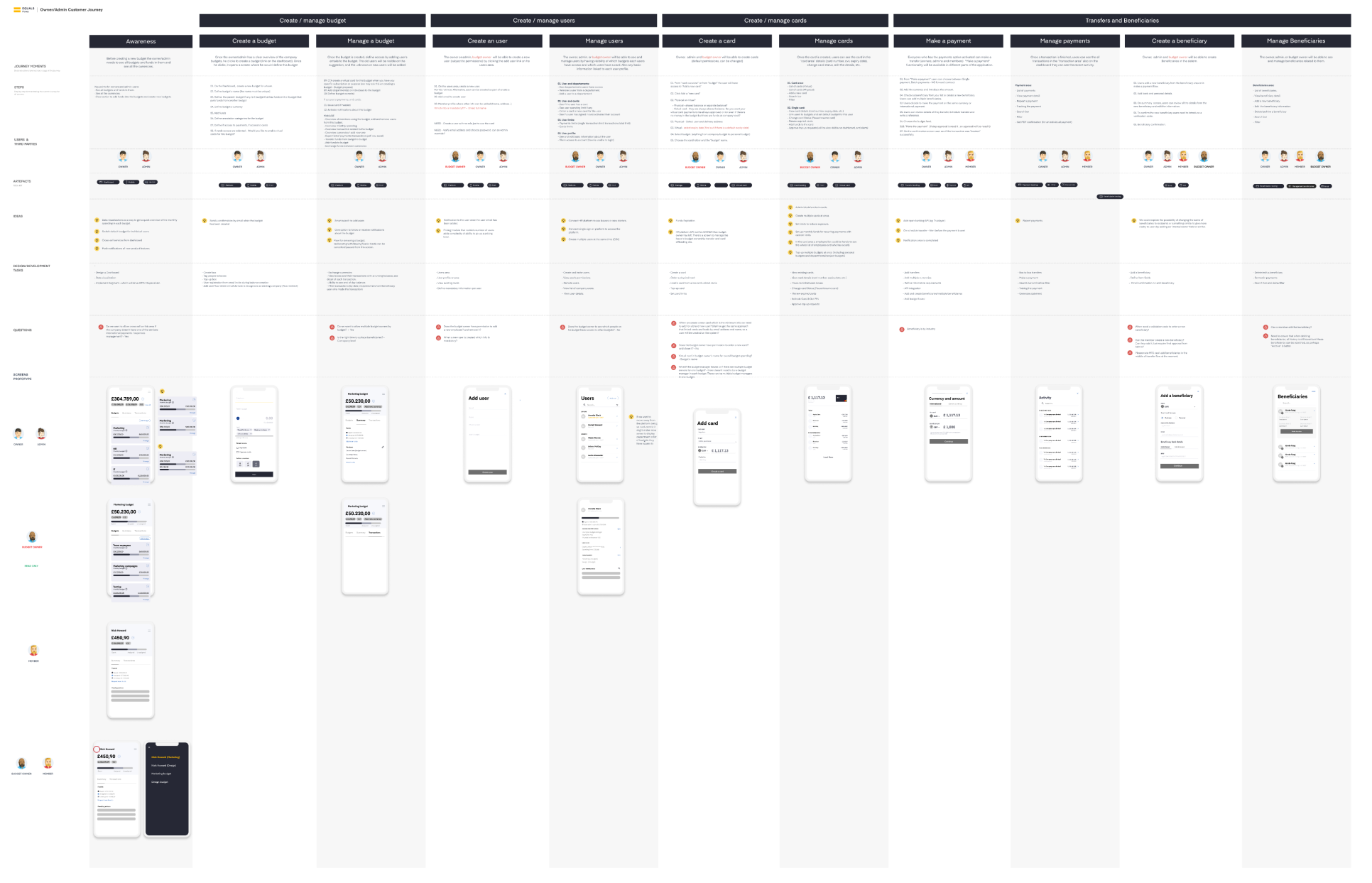

We began by defining core functionality across balances, user management, expense tracking, card management and integrations. These became the backbone of the roadmap. From there, I divided the work into clear categories:

- Must have: essential requirements such as multi-currency support, accessibility (AAA), light and dark mode, responsive layouts and scalability.

- Nice to have: features and refinements like quick feedback loops, data tracking and design-system-based improvements.

To bring clarity to sequencing, I led a two-week design sprint for each major product area. Each sprint involved:

- Aligning the team on goals and scope

- Running co-creation workshops to define solutions

- Prototyping and testing

- Refining and defining the final solution

We ran two squads in parallel, alternating their focus to maintain speed without sacrificing quality.

This structured, phased approach allowed us to progress rapidly while maintaining consistency across the entire product.

Research and Discovery

Before any design began, we invested heavily in understanding the market, the competition and the pain points within our existing ecosystem.

Our approach included:

- Benchmarking leading fintech platforms to identify whitespace opportunities

- Auditing existing Equals products

- Interviewing account managers and customer service teams to uncover recurring issues

- Mapping customer journeys to expose friction and duplication across systems

This phase produced a clear blueprint that informed both the architecture and the user experience, ensuring every design decision was grounded in evidence.

Establishing Design Principles

We defined a key guiding principle: "access at any point."

Every essential action, from funding an account to initiating a payment, needed to be instantly accessible wherever the user was in their journey. This shaped navigation, interaction logic and hierarchy across the platform.

We also built architectural maps detailing how balances interacted across businesses, departments, currencies and cards. This model became a shared reference for both design and engineering, creating alignment from the outset.

Building the Design Foundation

Before moving into UX flows, we established a robust Figma-based design system. This allowed us to move quickly and maintain consistency across hundreds of interfaces.

The design system:

- Enabled rapid, large-scale updates

- Supported both light and dark mode palettes

- Passed full accessibility testing

- Streamlined collaboration between squads

Although unconventional to prioritise UI before UX, it enabled high-quality delivery while maintaining flexibility as the product evolved.

Execution and Collaboration

We began by tackling two of the most complex features: multi-currency balances and account structures. I led workshops between design, product and engineering to define flows, dependencies and component behaviours.

To validate our work, we combined qualitative and quantitative methods:

- Moderated testing for key user journeys

- Unmoderated testing to refine micro-interactions and language

- FullStory analysis sessions to track behavioural data and identify unclear areas

This multi-layered validation process helped refine the product iteratively and strengthened confidence in our design decisions.

Cross-Functional Challenges

As the project progressed, design often moved faster than development, creating delivery challenges. I introduced structured documentation and frequent design–development syncs to maintain alignment and ensure design intent was preserved.

This strengthened communication, built trust, and ensured quality was upheld without slowing progress.

Results and Ongoing Impact

Since launch, the product has had a measurable impact on the business. The company's stock value has continued to rise, and revenues grew by 84% between 2020 and 2022, highlighting the success of the unified platform and its contribution to commercial growth.

Key outcomes:

- Unified all B2B offerings into a single platform

- Significant reduction in user friction and operational complexity

- Growing interest from European and North American markets

- 84% growth in H1 revenues (vs 2021)

- Design formally recognised as a strategic function within the organisation

Building on this foundation, we are now well advanced into the second phase of development, evolving the product to support white-label partnerships. This phase focuses on making the platform scalable and adaptable for external partners, extending the reach of Equals Money beyond direct customers and into new markets.

Reflection

This project redefined how I view design leadership. I'm most proud of how design became the glue that connected product, engineering and business, enabling collaboration, focus and clarity across the organisation.

If I could change one thing, I would push harder against legacy complexity during the UX phase. It was a valuable reminder that protecting simplicity early is key to achieving clarity at scale.

Key Takeaways

- Strong design systems enable quality, speed and consistency.

- Combining quantitative and qualitative insights creates more confident design decisions.

- Design can enable an organisation to move together with clarity and purpose.